Contents

This is also known as capital gains, and these can increase as high as up to +1000%, but there is no assurance that even the best stocks will rise quickly and if rise at all. A capital appreciation fund is a fund that invests in property, corresponding to excessive-growth and worth stocks, anticipated to aggressively recognize. The tax price you finally pay on the capital appreciation when you promote the investment is determined by how long you held it. If you owned the inventory for a yr or less, it will get added to your ordinary revenue and taxed on the identical price. If you owned it for greater than a 12 months, it is taxed at lower lengthy-term capital positive aspects charges. The maximum long-time period capital achieve fee is only 20 percent as of 2013.

But, in case there is a scrutiny after filing your ITR, you may have to show the documentary evidence for these costs. Suggest you to kindly consult a CA as well in this regard.. In March 2018 I have sold that flat for an amount of 8 lac. 1 – For calculations, suggest you to kindly consult a CA. If you are intending to sell A then Section 54 is applicable for LTCG exemption. C is a site purchased in August, 2017, and subsequently constructed.

And with in two years, i used that money to purchase a new flat, and it is only under my name. In case of gift, the period of holding of land is reckoned from the acquisition date of land by the owner who actually acquired the asset other than by inheritance, and gift. Need a clarification on my under-construction flat / property sale.

How do I save Capital Gains Tax from sale of Property?

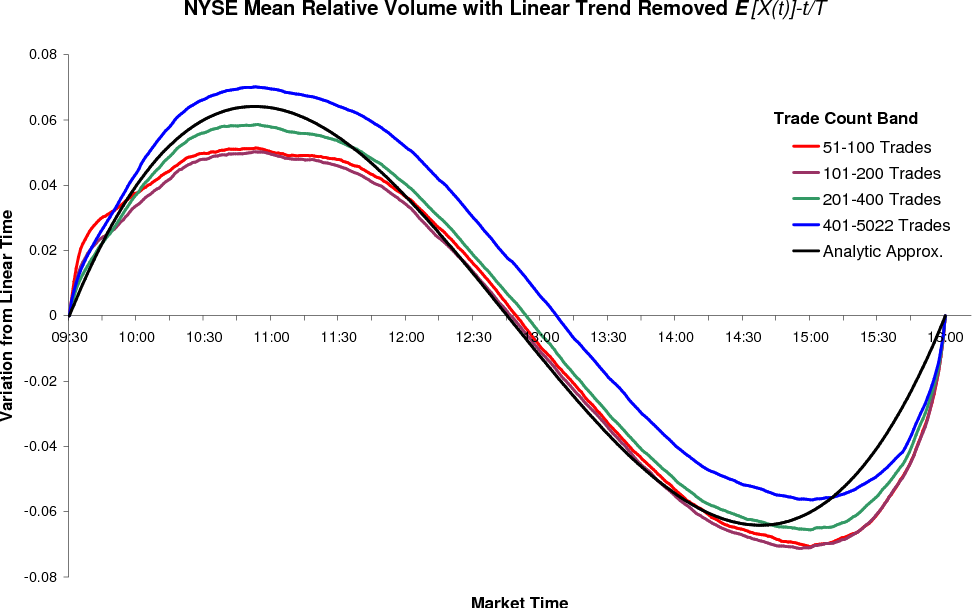

Have purchased a residential property in 2004 for the amount x. The relationship between time and yield on securities is called the yield curve. The relationship represents the time value of money – showing that people would demand a positive rate of return on the money they are willing to part today for a payback into the future.

– Index funds are passively managed, which means that the fund manager makes only minor, periodic adjustments to keep the fund in line with its index. Hence, Index fund offers the same return and risk represented by the index it tracks. The regular income earned from the debt instruments provide greater stability to the returns from such funds. Suitable for investors with higher risk appetite and longer investment horizon. The BlackRock Capital Appreciation Fund invests in US progress shares while seeking a steadiness of progress and risk. As of August 31, 2019, it outperformed the Russell 1000 Growth Index with a return of four.54% YTD.

If you are planning to use the sale proceeds to buy just a vacant plot then you can not claim tax exemption on Capital gains. Yes, you need to include the Capital Gains on sale of property in your income tax return and pay taxes on Gains. You mentioned capital gain from house sale can be used for house construction and plot value can be considered as capital gain reinvestment. Is there a split between plot cost to house construction cost specified. Any other recommendations about area of plot to area of house. I have some doubts about one of my land selling issue.

I have couple of question on Capital gain investment part. From then started paying the cost in installment till completion. Bought house under construction in Jan 2011 by making agreement deed betwewn builder n me. Sir, my query is whether I shall be liable to pay https://1investing.in/ any Capital Gain Tax. In this connection please intimate Section/Rule/Order under which joint ownership can be acceptable. Kindly note that rules of clubbing of income comes into picture if you gift a certain amount to your spouse, or minor children or Son’s wife.

No bill or any other parer left only cost of land from deed remain because that was 24 years ago. If i can pay 10 lac to the builder for construction cost as construction is still ongoing to reduce proportionate tax. And i m sure i cannt save tax by repaying some house loan. Another point to note is, the deducted capital gain becomes taxable if you buy another house within two years of the transfer of the original asset or construct a new one within three years. I have 30 Lakhs in Capital Gain Account and I want to buy another property within 2 years however new property cost is 25L .

Millennials, Afraid Of Commitment? Here’s How Fractional Ownership Can Help

Therefore, they could be a good long-time period core holding for a moderate-to-aggressive portion of an investment portfolio. Capital appreciation is commonly a stated funding objective of many mutual funds. These funds search for investments that will rise in value based on increased earnings or different basic metrics. As a result, capital appreciation funds are considered most appropriate for threat-tolerant buyers. However, capital appreciation is not the one supply of investment returns. Dividends and interest earnings are two different key sources of income for traders.

- If the inventory market had been to crash tomorrow, your positive aspects can be worn out.

- Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant.

- So either I should utilise LTCG which will arise by selling the old flat.

Capital appreciation is an increase in the value of an investment. It is the difference between the purchase price and the sale price of an asset. Gains on artwork and collectibles are taxed at odd earnings tax rates up to a most fee of 28 %. Also excluded from taxation are capital features from investments held for at least 10 years in designated Opportunity Funds.

Any infraction must repay the previously exempted taxes in the same year of the transaction. In assets, such as equities, a capital appreciation may occur over a short period of time. From the sale proceed, 8L LTCG + some money of the 23 L, we want to invest in 2 residential flats in each of my brother’s name seperately. To accomplish this what could be the requirements/restrcitions, kindly confirm. Sir can i use 4 lakhs for registration in april 2016 of new property to save the LTCG tax. But kindly note that ‘Joint ownership is acceptable but exemption can be limited to the share of ownership in the new property’.

share page

If so, I don’t think a seller can claim the tax deduction. I solely own an under construction flat registered on 31-Dec-2013. Till date it is not in my possession and is expected to complete in few months now. If that is the case whether I should pay the home loan before registry of second flat or after or it doesn’t matter.

One can sell a property at a price less than the Market price or even less than the Govt guidance value . But kindly note that the stamp duty or registration fee is applicable and calculated on the Govt guidance value and not based on the transaction value . 2 ) Is the registration of date of property is the deciding factor or the payment date . I.e If P1 will be registered on Dec 2016 then I will get the LTCG investment time for one year before & 2 year after from Dec 2016 . 1 ) Can I invest of the LTCG of 25 lakh of P1 in P3.

Equity Linked Savings Scheme

In equity-oriented mutual funds, the investors get profits in the form of capital gains and dividends. Capital gains are termed as the difference between purchase price and selling price of mutual fund units. Profits earned from sale of equity mutual funds, which are less than a year, are termed as short-term capital gains and taxed at 15%. The profits on investments held for more than a year is termed as long-term capital gains and taxed at 10% (if the long-term gains exceed more than Rs. 1 lakh). The dividend is amount distributed to unit holders as a part of the returns made by the funds.

capital appreciation Antonym, Synonym Thesaurus

When you promote an funding for greater than your cost basis, your internet profit will be taxed as a capital achieve. Assets which are appreciating capital appreciation meaning assets are, for the most part, belongings that acquire worth. Generally speaking, safer investment avenues are thought-about appreciating.

If you have sold house and would like to save taxes on LTCG, then you can invest in plot and then have to construct new house within three years of the sale of the property. She can gift the property to you and you then can sell the property and buy a residential property to save taxes. My mother in law wants to sell a house for 80 Lakhs which was acquired long before 1980 at a nominal price. Since there will be no benefit of using cost inflation index , so full tax liability seems to be there. Now she wants to distribute sale proceeds directly as GIFT between her son and married daughter through Fixed Deposit. Whenever you file your income tax returns, you will need to furnish a proof of your CGAS bank account to get tax exemption.

Liquid funds invest in securities with not more than 91 days to maturity. Funds holding securities with lower tenors have lower risk and lower return. Debt funds have potential for income generation and capital preservation. These funds carry the risk of getting calls wrong as catching a trend before the herd is not possible in every market cycle and these funds typically underperform in a bull market. Underperforming stocks and sectors are picked at low price points with a view that they will perform in the long run.